Log in to your registered account. Payroll for nonprofits is a complex issue.

Tax Exempt Status Irs Taxes Tax Irs

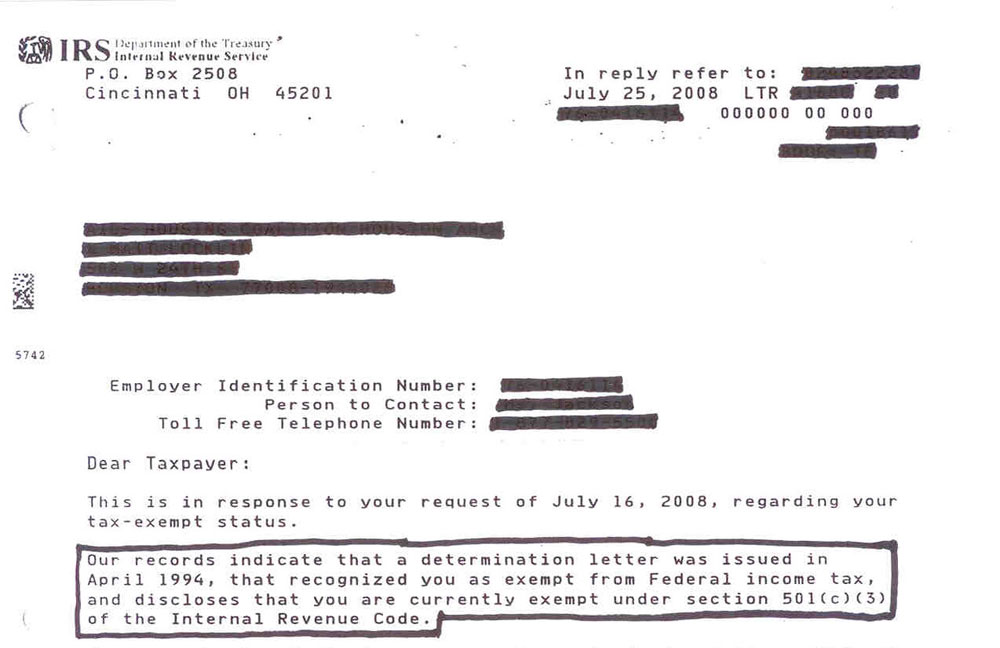

In the United States all non-profits recognized by the Internal Revenue Service IRS are assigned 501c3 status which legitimizes their tax-exemption.

How to find a 501c3 tax id number. Join us in our mission to help protect and preserve the Appalachian Trail. For years now obtaining the 501c3 tax-exempt status has been an intimidating and challenging process to churches and ministries - UNTIL NOW. Certain rules and exceptions apply that are different than what applies to for-profit companies.

Obtain 501c3 Tax-Exempt Status. Officially known as the Employer Identification Number a non-profits 501c3 number can be found on their 990 form which non-profits file every year. As if that complication isnt bad enough many nonprofits seem bound and determined to create their own rules and exceptions that are categorically incorrect and destined to get them in hot water with the IRS andor their state.

With the collaboration between signNow and Chrome easily find its extension in the Web Store and use it to eSign 501c3 form right in your browser. The ATC encourages collaboration flexibility and fairness with all employees and volunteers to enable participation. The Registry Verification Search tool allows you to query the Registrys database and verify whether a charitable organization or fundraiser has complied with the Attorney Generals registration and reporting requirements.

Every employing unit operating in Louisiana is required to complete and submit an employer application to. This is a state-level process that establishes a nonprofit corporate entity by the filing of Articles of Incorporation. The vast majority of nonprofits organize as corporations for a variety of reasons including liability protection for the officers directors and other key individuals.

Thursday April 07 2022. Work for an organization that was named one of Outside Magazines Best Places to Work in 2014. Offers expert Tax Preparation and Planning Services to local individuals businesses and Americans Citizens Overseas Resident Aliens 9.

Louisiana Unemployment Tax Account Application. Other parts of this initial process usually include obtaining a federal tax ID number FEIN from the IRS. The guidelines below will help you create an eSignature for signing 501c3 form download in Chrome.

Search the Files of the Registry of Charitable Trusts. According to the IRS Churches that meet the requirements of IRC section 501c3 are automatically considered tax exempt and are not required to apply for and obtain recognition of tax-exempt status from the IRS So it isnt required for your church to apply for 501c3 in order to be tax exempt. Find the extension in the Web Store and push Add.

Want to work for an amazing organization.

Awesome Sample 501c3 Donation Acknowledgement Letter And Description Receipt Template Donation Letter Non Profit Donations

Sample Donation Receipt Template Free Documents Pdf Word Letter Donation Letter Donation Letter Template Letter Templates

How To Find Your 501 C 3 Number For The School Auction Donation Letter Sherry Truhlar

What Is Ein How To Get Ein For Nonprofit 501c3 Organization

Pin By Cullinane Law Group Serving On Tips Tools For Nonprofits Nonprofit Startup Non Profit Start A Non Profit

What Is Ein How To Get Ein For Nonprofit 501c3 Organization

Does The Ein Become The 501c3 Number Homeschoolcpa Com

Reconsidering Charitable Tax Exemption A Modest Proposal For The Nonprofit 1000 Non Profit News Nonprofit Quarterly

Bluehost Com Start A Non Profit Nonprofit Startup Nonprofit Organization